Portfolio Drift:

Your 60/40 Became 82/18

You carefully constructed a balanced 60% Growth / 40% Floor portfolio in 2015—the perfect risk level for your goals. You set it and forgot it, trusting the market to do its thing. Fast forward to 2022: Your portfolio has silently drifted to 82% Growth / 18% Floor, exposing you to 35% more risk than you intended. When the 2022 correction hit, you lost 28% instead of 17%. That's $55,000 in additional losses on a $500,000 portfolio—all from neglecting to rebalance.

Portfolio drift is the silent killer of asset allocation. Your growth assets outperform your floor for years, gradually becoming a larger share of your portfolio. It feels great during bull markets—"let my winners run!" But when the crash comes, you're massively overexposed to risk you didn't plan for.

A 60/40 Growth/Floor portfolio created in 2015 without rebalancing drifted to 82/18 by 2022 due to growth outperformance. During the 2022 correction, the drifted portfolio lost 28% vs. 17% for a rebalanced portfolio. On a $500,000 account, that's $55,000 in additional losses from failing to rebalance.

- Drift is silent: A 60/40 portfolio can drift to 82/18 over 7 years without any action from you

- Crash amplifier: Drifted portfolios lost $55,000 MORE than rebalanced ones in 2022 ($500K portfolio)

- Annual rebalancing bonus: Vanguard research shows +0.35% annual returns over 30 years = $127K extra wealth

- Simple fix: Calendar reminder once per year, 30 minutes, or automate with robo-advisor

The Real Dollar Cost of Portfolio Drift

| Portfolio Strategy | 2022 Allocation | 2022 Loss ($500K) |

|---|---|---|

| 60/40 Never Rebalanced (Drifted to 82/18) | 82% growth | -$140,000 (-28%) |

| 60/40 Rebalanced Annually | 60% growth | -$85,000 (-17%) |

| Difference from Rebalancing Discipline: | $55,000 saved |

Methodology: 60/40 Growth/Floor portfolio created January 2015 with $500,000. "Never rebalanced" assumes no trades from 2015-2022. "Rebalanced annually" assumes rebalancing to 60/40 each December. 2022 losses based on actual S&P 500 (-18%) and Bloomberg Aggregate Bond Index (-13%) performance.

Watch Your Portfolio Drift in Real Time

See how a perfectly balanced 60/40 portfolio silently transforms into a risky 82/18 allocation over 7 years of market growth.

Curious how far your portfolio has drifted? Open the free Rebalancing Calculator →

Why We Neglect Rebalancing

Recency Bias: "Growth Always Wins"

After years of watching growth assets outperform your floor, our brains extrapolate the trend into the future. From 2015-2021, the S&P 500 returned 18% annually while floor assets returned just 3%. Investors watching growth dominate year after year concluded: "Why rebalance INTO the floor? Growth is clearly better!"

Then 2022 happened: Growth fell 18%, floor assets fell 13%, and the 60/40 portfolio that had drifted to 82/18 got crushed. The investors who religiously rebalanced—selling growth winners and protecting their floor—were rewarded with 11% less downside during the crash.

The "Let Your Winners Run" Myth

In individual stock picking, "let your winners run" is sound advice—sell losers, hold winners. But in asset allocation rebalancing, it's the opposite. You want to "sell high" (trim outperforming assets) and "buy low" (add to underperforming assets) to maintain your target risk level.

What feels right (wrong decision): "Stocks are up 30% this year! Let's ride the momentum. Don't sell winners."

What actually works (correct decision): "Growth is up 30%, now overweighted. Trim to target allocation. Protect your floor which is relatively cheaper."

Rebalancing forces contrarian behavior: selling assets that have run up (expensive) and buying assets that have lagged (cheap). That's how you maintain consistent risk exposure.

Inertia and Complexity: "It's Too Much Work"

Rebalancing requires action—logging in, calculating percentages, executing trades. Many investors simply can't be bothered, especially when the portfolio is "doing fine." But this inertia creates hidden risk that only becomes visible during crashes.

Think rebalancing is too complicated? Our free calculator does the math in 30 seconds →

"I Don't Buy Bonds—They're for Boomers"

We hear it every day. And look, we get it. But rebalancing isn't about loving bonds; it's about locking in wins.

When you don't rebalance, you aren't "staying aggressive"—you're letting the market decide your risk for you. You went from a calculated risk-taker to a "hope-and-pray" gambler because you let your winners turn your portfolio into a one-trick pony.

The 40% "Floor" isn't boring bonds—it's Dry Powder:

- T-Bills / I-Bonds — Government-backed, inflation-protected

- High-Yield Savings — 5%+ APY in 2024

- Short-duration Treasuries — Low volatility, quick liquidity

- Cash — The ultimate dry powder for buying dips

It's not about loving bonds. It's about having Dry Powder when everyone else is panic-selling at the bottom.

The Long-Term Rebalancing Bonus

Research from Vanguard shows that disciplined annual rebalancing adds 0.35% in excess returns annually over 30 years compared to never rebalancing. On a $500,000 portfolio, that's $127,000 in additional wealth from a 30-minute annual task.

The benefit comes from systematically buying low and selling high—trimming assets after they've run up (selling expensive) and adding to assets that have lagged (buying cheap).

How to Implement Disciplined Rebalancing

1. Set a "Portfolio Holiday"

One date. One task. 30 minutes. That's all it takes.

- Pick one date per year (December 31st, birthday, or tax day)

- Log in, check percentages, execute trades to rebalance

- Combine with tax-loss harvesting in December for efficiency

Calendar reminder set = 0% willpower required.

2. The 5% Threshold Rule

Small drift? Ignore it. Save your trades for when it matters.

- If target is 60% stocks, only rebalance at 65% or 55%

- Reduces trading costs and taxes

- Example: Stocks at 64%? Do nothing. Stocks at 66%? Time to rebalance.

5% threshold eliminates 80% of unnecessary trades. Check if you've hit the threshold →

3. Use the "Rebalance with Cash" Trick

No selling = no taxes. Direct new money to the underweight side.

- Instead of selling winners (triggering taxes), direct new contributions to underweight assets

- Example: Currently 66/34 but targeting 60/40? Put all new money into floor assets

- Works especially well for regular 401(k) or IRA contributions

Tax-free rebalancing preserves more of your returns.

4. Automate It

Remove yourself from the equation. Robots don't panic.

- Robo-advisors like Betterment, Wealthfront, or Vanguard Personal Advisor automatically rebalance

- The 0.15-0.35% fee is worth it if it prevents $55K in crash losses

- Bonus: They also optimize for tax-efficient trades across account types

0.25% fee prevents $55K+ in crash losses.

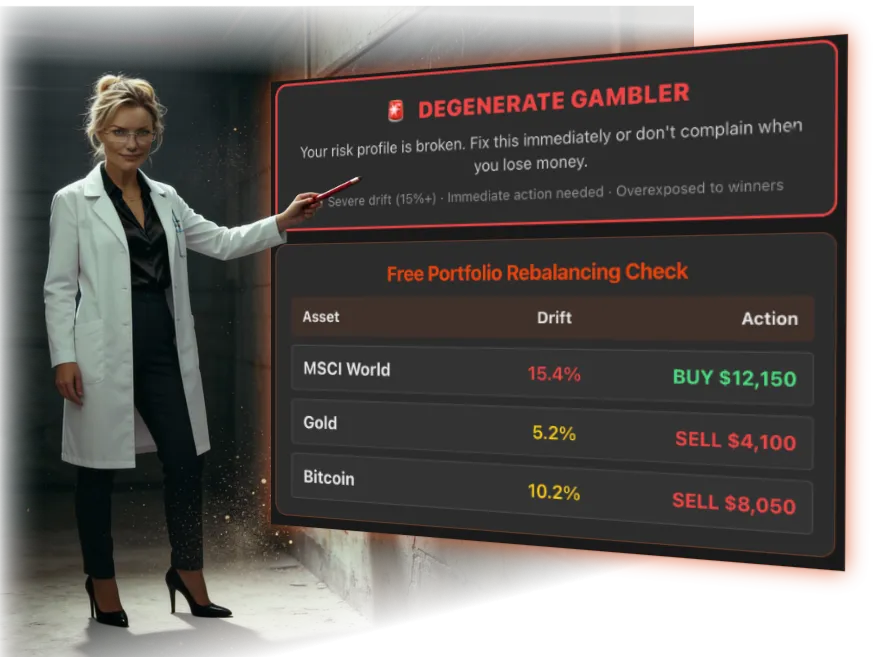

Has your portfolio drifted without you noticing? Get your free portfolio roast and find out if you're overexposed to risk.

Data sources: Portfolio drift calculations using historical S&P 500 and Bloomberg Aggregate Bond Index returns (2015-2022), Vanguard "The Case for Annual Rebalancing" research, rebalancing bonus data from Dimensional Fund Advisors, 2022 correction losses from actual market performance. This content is educational and not financial advice. Consult a licensed advisor for personalized guidance.

Related Articles

Is Your Portfolio a Lie? The 73% Diversification Trap

73% of 'diversified' tech portfolios move in lockstep with 0.85+ correlation. If you own 10 stocks, you might own one risk. Find out.

11 min readInvestment Fees Cost $810K Over 30 Years

A 2% fee vs 0.10% index fund = $810,139 lost over 30 years. See how hidden fees (advisor fees, expense ratios, trading costs) drain your wealth + free calculator.

8 min readPerformance Chasing Costs 43% Returns

Learn why chasing last year's hot sectors destroys wealth. Data shows sector rotation fails 75% of time. Stop the $850K mistake with 4 simple rules.

14 min readContinue the Series

This is Week 7 of our 8-part investment mistakes series.